Review of Market Pinball Wizard + Elliott Wave Theory

November 12, 2020 pastLes

Avi Gilburt'due south Elliot Wave Trader is a subscription based analytical service and the disclaimer is stated very clearly that information technology is non a trading recommendation or advisory service. The offering is very all-encompassing in its range of trading marketplace coverage. The more, or lesser controversial attribution of market trends to homo impulse and sentiment (equally it complies with Elliott Wave Trader theory) rather than more objective and increasingly automatic review methods, is one of the Elliott Moving ridge Trader'due south main marketing features.

The main rational behind subscribing to a service like this is to learn information that allows us to trade more profitably, does this service enable that? This Elliot Wave Trader review sets out to address these questions; what you get, pros v cons and more than.

Overview

- Name: Elliot Wave Trader

- Type: Elliot Moving ridge based investment analytical service.

- Website: ElliotWavetrader.net

- Founder: Avi Gilburt

- Services:Live trading room and grooming material with specific reference to the Eliot Wave theory.

The Avi Gilburt'south Elliot Wave Trader arrangement is a propriety, market place analytical service provided by a 17 person strong team of analysts led by Avi Gilburt. The Elliot Moving ridge Trader similarly to Andrew Corking's Project 303, is but i of an exponentially growing number of similar services offering a 'live trading room'.

Trading has become, in no small part due to the coverage and reach of the internet, a popular and possibly over promoted means of catapulting moderately resourced 'Joe Lather' to a position of transformational wealth. In that location are well documented cases of traders accumulating enormous wealth from well placed trades, but the vast majority of these claims are unsubstantiated and or exaggerated. The trendy 'work smart and not hard' ethos is fed by extravagant claims of traders accruing massive profits while needing to only spend a few hours a calendar week executing trades based on data obtained from subscription services similar Avi Gilburt's Elliot Wave Trader.

The live trading room provides subscribers with live data viewable in the virtual trading room. In the increasingly competitive realm of subscription based trading advisory services, it is becoming more and more than challenging for informational services to differentiate their offerings from their competitors. The Elliot Wave Trader analytical theory is certainly a differentiating factor, whether this theory with its attendant market analysis and interpretations is a reliably better way to trade markets is the subject area of this review.

I signed upwardly for the 15 day free trial period in social club to get an accurate wait at and experience for the offer.

What is Avi Gilburt's Elliot Wave Trader?

Avi Gilburt's Elliot Moving ridge Trader is a trading analytical service that provides subscribers with access to a virtual live trading room where specialist market place analysis across a range of market sectors is made in real fourth dimension. The analysis is based on Elliot Wave theory.

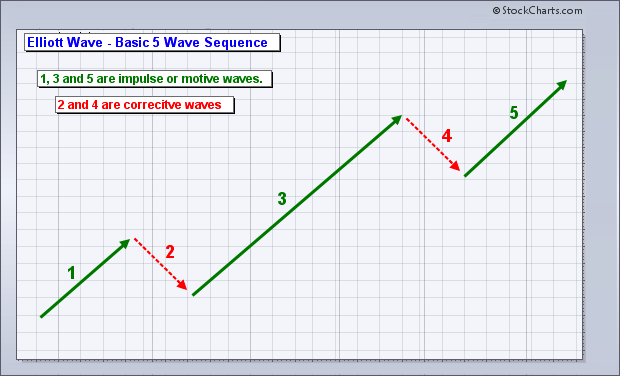

Elliot Moving ridge theory works on the premise that public sentiment and mass psychology moves in a wave blueprint that can be read and used to analyse market behaviour. At the core of the theory is the view that positive public sentiment moves in 5 wave sets and when this cycle of public sentiment is completed, then a subconscious reset of sentiment occurs resulting in a shift in the opposite direction. This is supposedly attributable to natural human behavioural patterns and non the product of extraneous news events.

Avi Gilburt asserts that no less an economical luminary than the former Chairman of the US Federal Reserve, Alan Greenspan subscribed to the Elliot Wave Theory. Mr. Greenspan famously told the Joint Economic Committee that the stock market place is "driven by human being psychology" and "waves of optimism and cynicism. Mr. Greenspan may well accept spoken those words but Avi Gilburt'due south interpretation is obviously subjective.

Avi Gilburt postulates the theory that man's progress and regression, advances in the sequence of three steps forrard and followed by two steps back. Referenced reading is, Elliot Wave Principle by Frost & Prechter.

When analysing the basic five or three wave trends, the (dominant) moves in the direction of the overall trend are referred to every bit the impulsive or motive waves and the moves that are counter to the overall trend are corrective waves.

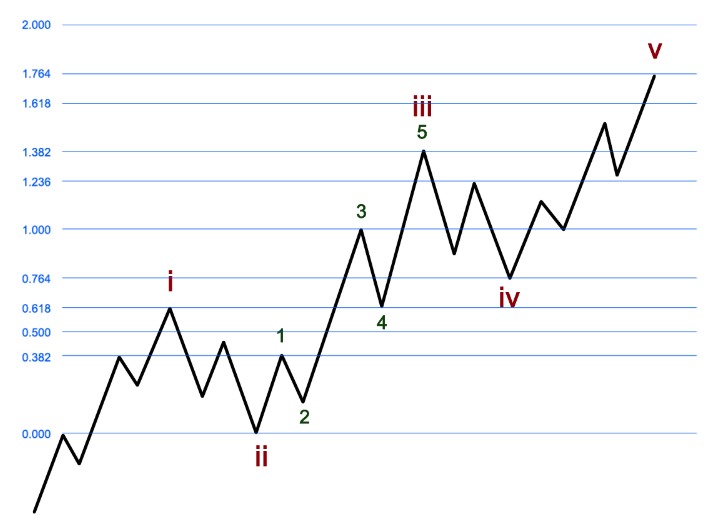

Avi Gilburt digs down deeper into the Elliot Wave theory and theorises that each impulse wave subdivides into 5 sub-waves and that this subdivision occurs infinitely. His interpretation and implementation of this deeper assay is what Avi Gilburt "lovingly" calls his Fibonacci Pinball.

In an expansive and detailed explanation of his Fibonacci Pinball strategy, Avi Gilburt illustrates the efficacy of the methodology in determining when to have profits or points at which to set stops. The graph below illustrates the sub-waves in the impulsive waves (five phases) and the corrective waves (three phases).

Who is Avi Gilburt?

Avi Gilburt is a trained accountant and lawyer. A tiptop academic achiever, he graduated with economics and accounting majors and passed the entire CPA exam presently after graduation. He obtained a Juris Doctorate from the St. John's School of Law, New York and later obtained a (LL.Grand.) masters of law in taxation from the NYU Schoolhouse of Law.

Avi Gilburt co-founded ElliotWaveTrader.net in September 2011 with Richard Hefter and Communication Trade. Prior to starting his trading career, he was a successful lawyer, working as a partner and national manager at a major national firm. In the course of his legal career he steered several major acquisitions with values ranging from millions to billions. This background has given him a thorough grounding in assessing the workings and valuation of businesses.

Forced to withdraw from his accounting and legal practice by the serious illness of his second wife, he initially started 24-hour interval trading to supplement his household income. In the pursuit of his hobby' of researching various methods of stock marketplace analysis, he arrived at the decision that Elliot Moving ridge theory was the but analysis method that fabricated sense to him. He formed an alliance with Harry Boxter of TheTechTrader.com and became a subscriber to the sight. Members of the sight and Harry Boxter noticed his top and bottom target recommendations for stocks and equities were quite accurate.

Harry Boxter encouraged him to establish his own advisory service and live trading room, he introduced him to Richard Hefter, who despite initial scepticism regarding the concept of Elliot Wave trading was convinced to become on board with the establishing of the ElliotWaveTrader.internet and the development of the platform.

Other FAQ's

Is The Avi Gilburt'southward Elliot Moving ridge Trader legit?

The curt answer to the above question is a conclusive yes. Avi Gilburt is a highly respected annotator with an extensive and credible track record. The list of specialists contributing to the ElliotWaveTrader.net analytical service is comprised of more than fifteen highly accomplished analysts. The ElliotWaveTrader.net service has existed since 2011 and has a growing membership of more than 5000 subscribers, many of whom requite glowing testimonials every bit to the service'due south accuracy. At that place is an extensive reference library of past ElliotWaveTrader.cyberspace market analysis and the quality of this assay tin can be back-checked in terms of actual market performance.

Can You Trust Elliot Wave Trader recommendations?

The numerous positive testimonials from subscribers are not independently verified but there is much information to support the claims made by ElliotWaveTrader.net . Examples are given of past instances where the service has made accurate analysis in periods of existent and predicted economic upheaval. The July 2011 prediction made by Avi Gilburt that the Usa$ would stage a multi-year surge from 74 to a target of 103.53, was realised in January 2017 when the Us$ reached 103.82 before receding, again every bit predicted.

When the 2016 Usa presidential election was looming in that location was much anticipation among many investors, concern was rife that the market place would crash if Donald Trump won the ballot. Avi Gilburt correctly predicted that the election result would not impact stock market trends.

Past predictions by him can exist plant online on MarketWatch and NASDAQ websites. There are numerous testimonials past both subscribers and gratis trial users, many of them commenting that all-encompassing back-checking of his assay with actual market events, revealed a great degree of accurateness.

As is the case with many trading advisory services, the analysis of Avi Gilburt'southward Elliott Moving ridge Trader cannot offer an ironclad guarantee as to the accuracy of the analysis. The annunciation that the service is analytical and not an advisory service may well be intended as a disclaimer of sorts.

Trading Strategy

The 'recommended' trading strategy is based on Elliott Wave analysis and the deeper application of Avi Gilburt'south Fibonacci Pinball analysis.

The Specialist Advisors

The trend towards large numbers of varied, added value offerings and teams of eminent analysts and advisers as utilised by other trading informational services is also a feature of the ElliottWaveTrader.net.

- Avi Gilburt: The founder of the Elliott Moving ridge Assay, Avi Gilburt is both a trained lawyer and accountant. He is known for developing and implementing an estimation of the Elliot Wave theory that he calls the Fibonacci Pinball Strategy.

- Zac Mannes: Co-host of the Stock Waves service in the ElliottWaveTrader.net trading room that provides alerts and trade ready-ups for individual stocks. Zac Mannes also co-hosts the mining stocks portfolio service and the site'south weekly Beginners Circle Webinar.

- Garrett Patten:Fulfilling the part of EWT's primary educator, Garrett works on the development of an educational course on Elliott Wave assay and co-hosts the weekly Beginners Circumvolve webinar. He is the host of his ain World Markets service and is the co-host of Stock Waves, the Mining Stocks Portfolio and Avi & Garrett's Live Video.

- Arkady Yakhnis: A graduate of Moscow Country University, he has experience managing private accounts at an investment consulting house. He likewise worked in the induction heating manufacture earlier joining Elliott Wave Trader. He was one of the first analyst at EWT.

- Mike Golembesky: Michael came to EWT with all-encompassing feel in the fields of real estate, ES Merchandise Alerts service, investing and finance. He contributes frequently to Avi'southward Markets Alert service and also hosts the VIX trading service.

- Larry White: Larry comes from a background of executive roles at Toshiba, ISOETEC and Panasonic. He joined EWT in October 2012 where he focused on mining stocks as well every bit the GDX and GDXJ mining ETFs.

- Victor Nguyen: Victor has been trading since he won his first stock trading contest in the fifth grade. He hosts the the Alphabetize Quant Signal service within the EWT Trading room. This service generates signals from an automated system using an algorithm developed past Victor.

- Princely Mathew: The second identify finisher in the 2015 World Cup Championship of Futures Trading, Princely has been actively trading since 2003. He hosts The Smart Money service in the EWT trading room, he provides analysis in U.S. disinterestedness indexes as well as miners and crude oil.

- Ricky Wen: Trading professionally since 2009, Ricky Wen has focussed primarily on stock options and the ES futures. He hosts the ES Trade Alerts service at EWT, his other contribution is his Due east-mini S&P 500 assay which features on Avi's Markets Alert service.

- Harry Dunn: A veteran Wall Street trader, Harry Dunn authors Harry'due south expanded Dunn Weekend Report. Individual stocks analysis by Harry can be found in the EWT Stock Waves service.

- Dr. Cari Bourette: The eminently qualified Dr. Cari has PsyD clinical psychology, MS in Geoscience, MS in counselling and BS physics. She has developed a 'Market Mood Indicator to forecast daily Southward&P 500, crude oil, gilded, and USD trends. Her research which reaches back to 2006, converts social mood data into numerical data and factors this along with internet search data to identify market trends.

- Luke Miller: An associate Professor of Economics & Business at St Anselm Higher, he earned the Gilbreth Memorial Fellowship, as the top PhD educatee in the U.S. in 2003. Luke is the Bayesian timing specialist at EWT. Luke Miller provides consulting services to Bluechips like Morningstar, Amazon, UPS, Verizon and Oracle.

- Ryan Wilday: The EWT in house Cryptocurrency specialist, Ryan Wilday has more than seventeen years of experience in trading equities, futures and options. He has traded cryptocurrencies since 2013 and these days aligns his considerable knowledge of the sector with the application of Elliott Wave Theory and Fibonacci Pinball analysis. His Cryptocurrency Trading Service on EWT was launched in August 2017.

- Leo Valencia: The programmer of the Gamma Optimizer tool, Leo Valencia is the host of the Gamma Optimizer service at EWT. An electrical engineer with a PhD in Physics from Stanford University, Leo has more than 20 years of enquiry and evolution feel. He has developed a Deep Learning Algorithm which guides members with options trading recommendations. Leo is also the options educator at EWT.

- Carolyn Boroden: Carolyn started her trading career on the floor of the Chicago Mercantile Exchange in 1978. Regularly featured on the Off The Charts segment of CNBC'due south Mad Money with Jim Cramer. A highly regarded specialist in the area of Fibonacci cost and timing analysis, Carolyn joined the EWT squad in Dec 2019. She authored Fibonacci trading in early 2008. Carolyn Boroden's Fibonacci Market Analysis is a contributor to the ElliottWaveTrader Trading Room.

- Lyn Alden Schwartzer: Lyn has a Bachelor's degree in electrical & electronics engineering and a Main's degree in engineering direction. Lyn provides macroeconomic analysis in Avi'south Marketplace Alerts service. Her work has been featured widely in the financial media.

- Jason Appel: A financial markets veteran, Jason started his career on the floor of the Chicago Board of Trade in the early on 2000s. He holds a BSC in Economics from DePaul University. Jason has been applying his mind to and using Elliott Wave and Fibonacci Pinball analysis since 2014.

What You Get

- Admission to the Live Trading Room with Elliott Moving ridge based market assay.

- The Marketplace Update, this is a nightly assay of the S&P 500 past Avi Gilburt and the team.

- Analysis over a time horizon of days to several months roofing U.S. and globe equity indices, stocks, bonds, resource, cryptocurrencies, free energy and forex.

- Interaction and Insights from and between members in the interactive virtual room.

- Analysis led by Avi Gilburt and his team of seventeen prestigious specialist advisors, most of whom are regarded every bit thought leaders in their respective niches.

- Access to the Pedagogy department which features manufactures, videos, suggested reading lists and an expansive glossary of Elliott Wave terms and abbreviations commonly used in the Trading room.

- Posting privileges in the Trading Room.

- The following service options

i) Flagship Service – S&P 500, Metal, Energy, USD, Bonds & More

- Avi's market alerts covering U.S. disinterestedness indices, bonds, precious metals, energy & U.S.$ plus market sentiment analysis.

ii) Flagship Add-Ons

- Avi & Gareth Patten'southward live video providing interactive webinars three times a day covering moving ridge counts and fundamental charts.

- Harry'due south Hot Corner, spirited commentary from the veteran Wall Street annotator Harry Dunn. Opinion on U.S. indices, precious metals and bonds.

- Ricky Wen's Intraday entry / exit alerts for day trading the Emini S&P 500.

- Mike Golembesky'south trade set-ups in ETFs and options related to the VIX and equity indices.

- Bayesian Analysis, Luke miller'south propriety assay of Avi's SPX and GDX charts.

- Bayesian Betoken Alerts, this is an add-on to the Bayesian Analysis Service, provides ETF swing trade signals on U.Due south. indices, energy, metals & more.

- Princely Mathew's, The Smart Coin provides directional analysis and trade signals mainly on the U.S. Disinterestedness Indices, GDX and USO. The analysis is based on Princely's propriety range of indicators.

- Victor Nguyen'due south, Index Quant Signals that are the production of a propriety quantitative algorithm, analysing day & swing trades in ES, gold & equity indices / ETFs.

iii) Fibonacci Assay

- Carolyn Boroden's advanced Fibonacci time & price analysis spotlights high probability U.S. stocks and indices.

iv) Stocks

- Stock Waves, an extensive analysis of U.S. stocks by Zac Mannes, Garrett Patten, & Lyn Alden Schwartze, comprising watchlists, nightly videos and earnings calls.

- Mining Stock Portfolio, by Avi Gilburt, Zac Mannes and Garrett Patten. This is an intermediate-term model portfolio and watchlist of gilt stocks that includes entry / exit alerts and trackable functioning. There is no free trial available of this feature.

v) Options & Commodities

- The Gamma Optimizer, recommends options merchandise prepare-ups and features Leo Valencia's propriety tool for selecting optimal strike & expiry dates for options trading.

- Larry's Live Trading, Larry White focuses on oil, miners and other commodity classes, issuing intraday merchandise alerts and alive streaming threads.

vi) Currencies & International

- World Markets is hosted by Garret Patten and provides coverage of ten international markets. The covered indices are the FTSE100, DAX, Euro STOXX 50, Nikkei, Hang Seng, India's Keen 50, Mexico'southward IPC Index, Brazil'southward Bovespa, Australia's ASX 200 & the Shanghai Composite.

- Forex, Afkardy Yakhnis provides coverage of major and pocket-size forex pairs, the principal focus being on the six majors; EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD and AUDUSD. Arkady Yakhnis as well provides analysis of metals and crypto trading pairs.

- Cryptocurrency Trading, hosted by Ryan Wilday, analysis and trade alerts focused on the likes of Etherium and Bitcoin.

seven) Additional Features

- All the above services include e-mail and text warning options. The display options in the live trading tin can also be customised.

- The New Member Weekly Webinar on a Wednesday which is a guide every bit to where to find and how to interpret analysis that is of interest to the subscribers.

- The Education Section which features articles, videos, suggested reading and an extensive glossary of Elliott Wave terminology & common abbreviations used in the trading room.

Costs & Refunds

There are several different subscription options. A 15 day limited free trial period is bachelor. The paid options start at $99.95 per month and $275 per quarter. At that place are longer term subscription options available in the form of $525 for what is termed a semi-almanac subscription and $1000 for an annual subscription.

While EWT outlines various scenarios under which they may unilaterally stop the service, no mention is made of a refund policy.

Pros 5 Cons

Pros

- The informational team is comprised of academically accomplished contributors.

- There is a comprehensive library of educational fabric explaining Elliott Wave Trading and Fibonacci Assay.

- The live trading room facilitates exchanges between analysts and members too as fellow member to fellow member interaction.

- The initial 15 twenty-four hour period costless trial membership, though limited in access, does allow one to investigate the EWT offering earlier committing to a paid subscription.

- Recent 2020 member testimonials attest to the accuracy of the analysis during market turmoil related to the Covid-19 crisis. It must be noted that these testimonials are unsubstantiated.

Cons

- The credible lack of a refund policy may exist problematic for many prospective subscribers.

- There are numerous complaints from subscribers about poor levels of communication when contacting EWT, this in spite of claims past EWT to offer timely response to all queries.

- In as much as there are numerous recent positive testimonials as to the accuracy of the analytical content on EWT, the lack of independent verification is problematic.. There are many, many online reviews pre-dating 2020 where the quality of the belittling output is widely criticised. Ane tin speculate equally to whether the recent positive testimonials are the result improved analysis or simply the result of a marketing thrust.

- Some of the free services appear to be non really free as members take complained that their admission to these free features are withdrawn when they cancel their subscriptions.

Quick Recap & Decision

The Avi Gilburt's Elliott Wave Trader belittling service is an offering that has unique features non offered by the myriad of other trading informational services. The underlying theory of Elliott Wave Trading applies a moving ridge pattern to interpreting the furnishings of human sentiment as it manifests in trading patterns. EWT emphasise that their offering is a marketplace analysis and non a trading informational service. The Elliott Wave Trading system and the further developed Fibonacci Analysis are complex analytical methodologies that require a studious arroyo to gain an effective understanding. If the offered analysis is used in combination with other market information sources it is probably of pregnant value.

The EWT analysis in utilising the expertise of it'due south large group of specialist analysts, covers an extremely wide range of the trading spectrum. This extensive range of analytical information is in all probability beyond the needs of almost individual traders.

Worth Subscribing To?

For the serious or more established trader who is prepared to put in the effort required to understand the Avi Gilburt's Wave Trader and Fibonacci Assay, the service is probably worth including as office of a trader's wider information portfolio.

Source: https://greenbullresearch.com/avi-gilburts-elliot-wave-trader-review/

0 Response to "Review of Market Pinball Wizard + Elliott Wave Theory"

Post a Comment